are 529 college savings plans tax deductible

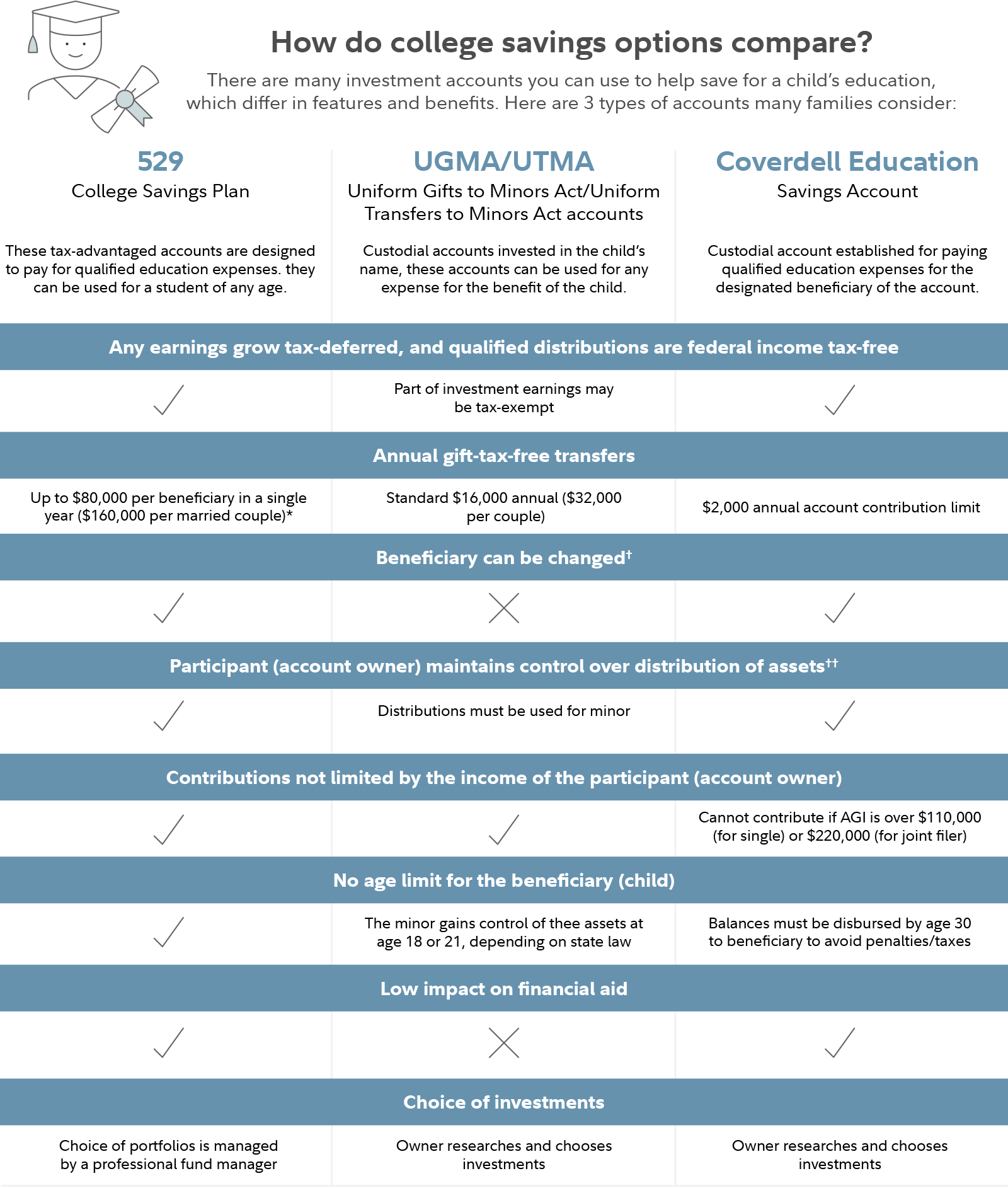

The 529 savings plans receive tax benefits when they are used to cater to education expenses Crandall-Hollick 2018. How are some families planning for future education expenses.

529 College Savings Plans What You Need To Know

LoginAsk is here to help you access Oregon 529 Plan Deduction 2020 quickly and.

. Ad Learn the basics about 529 savings plans. Ad Low Fees High Ratings. Choose the best option for you and your family.

The Path2College 529 Plan operated under the Georgia Office of the State Treasurer gives you a way to start saving today to prepare for a childs tomorrow. A 529 plan is an excellent option to start saving for your childs college education early. Never are 529 contributions tax deductible on the federal level.

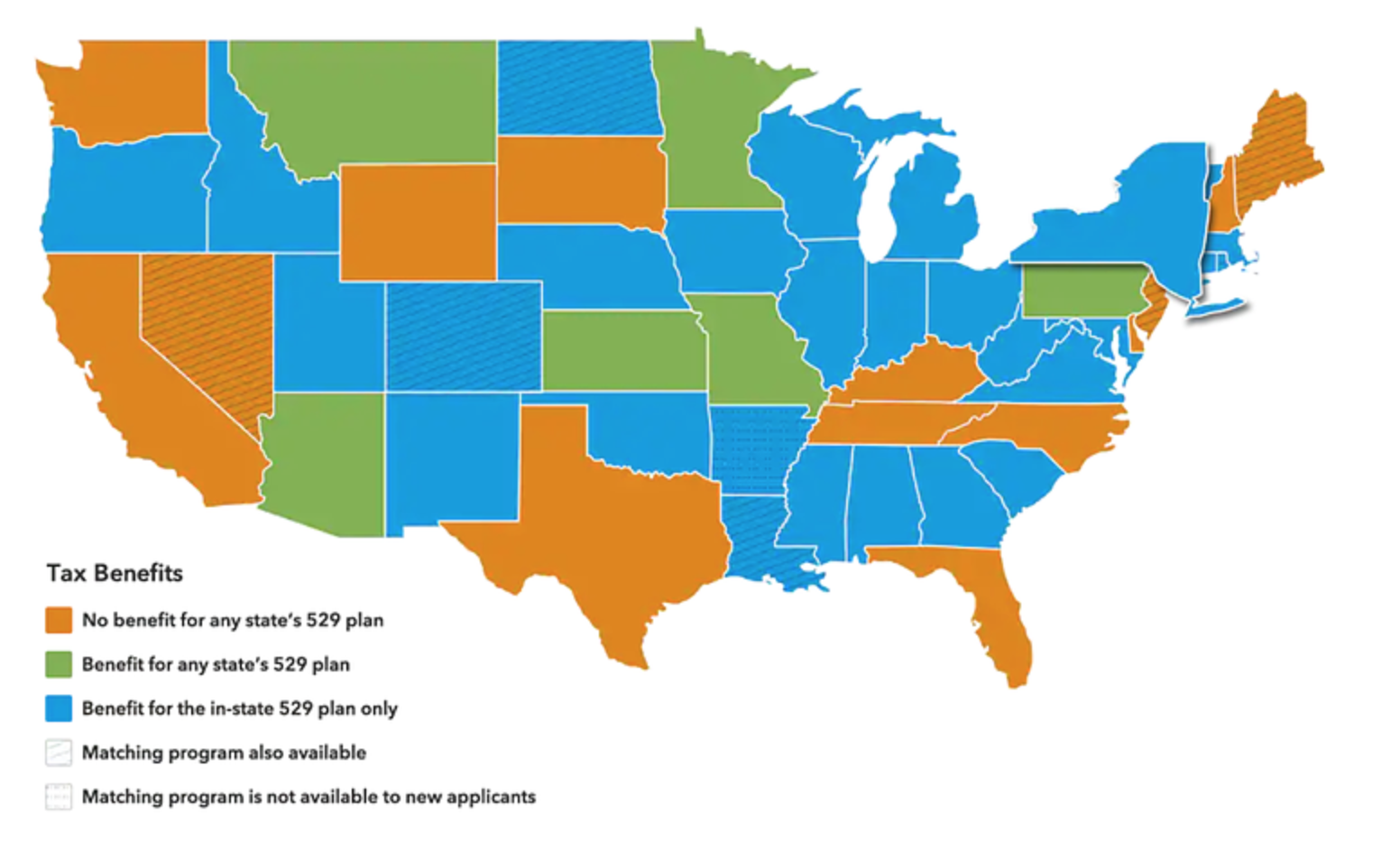

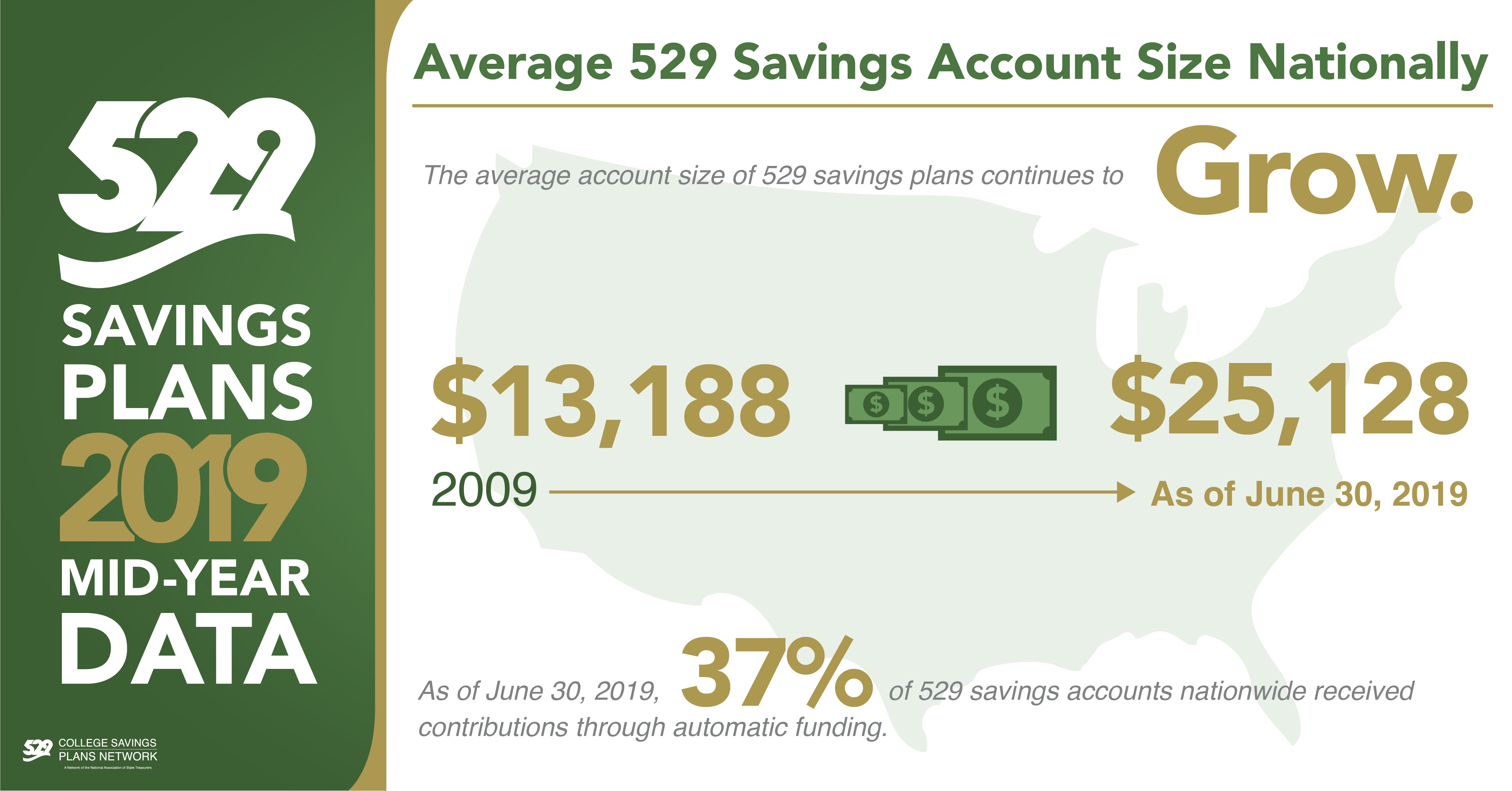

Owners of 529 plans may also qualify for state-level tax deductions. Ad Thinking About Saving For Your Childs College Fund. According to Sallie Maes How America Saves for College 2021 report 37 of families used a college savings account like a.

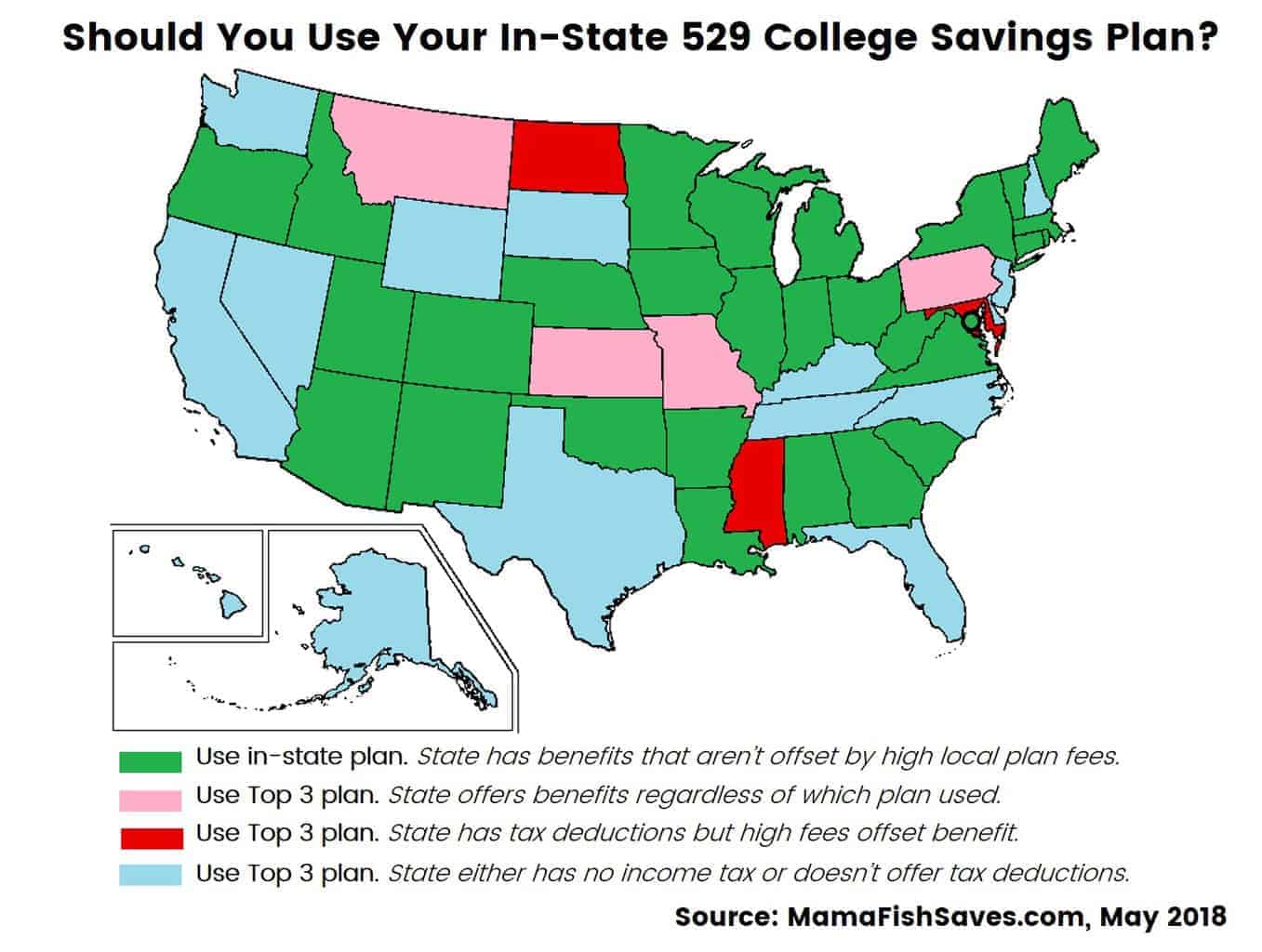

Keep More Money Now. Your contributions to a 529 plan arent tax-deductible on a federal level but might be on the state level. The Maryland 529 plan tax deduction is a Maryland state tax deduction you can receive for money you contribute to your Maryland 529 college plan savings and prepaid in a.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. New Look At Your Financial Strategy. 529 plan contributions arent typically tax-deductible but they are exempt from federal.

Get Fidelitys Guidance at Every Step. The amount of your 529 state tax deduction will depend on where you live and how much you contribute to a 529 plan during a given tax year. Visit The Official Edward Jones Site.

Never are 529 contributions tax deductible on the federal level. The Vanguard Group Inc serves as the Investment Manager and. Ad Search For Answers From Across The Web With Topsearchco.

See Why Were Ranked Among The Best College Savings Plans. 529 Plan Tax Benefits 529 plans. The student loan interest deduction allows a tax break of up to 2500 for interest payments on loans for higher education.

In 2021 529 contributions up to 15000 for individuals or 30000 for married couples filing jointly will. Federal Tax Deduction for 529 Plans. There are any number of reasons to love 529 plans as a college savings option such as the lack of federal income tax and the flexibility to add or invest money how you see fit but some.

Tax-Advantaged College Savings Plans. College Savings That Works For Your Family Schedule And Budget. Discover The Answers You Need Here.

Check with your 529 plan or your state to find. Yes grandparents can claim the deduction for contributing to a 529 if they live in one of the 34 states that offer a state income tax deduction for 529 college-savings plan contributions. But you may be.

Many states offer tax deductions for 529 plans. However some states may consider 529 contributions tax deductible. 529 plans are flexible.

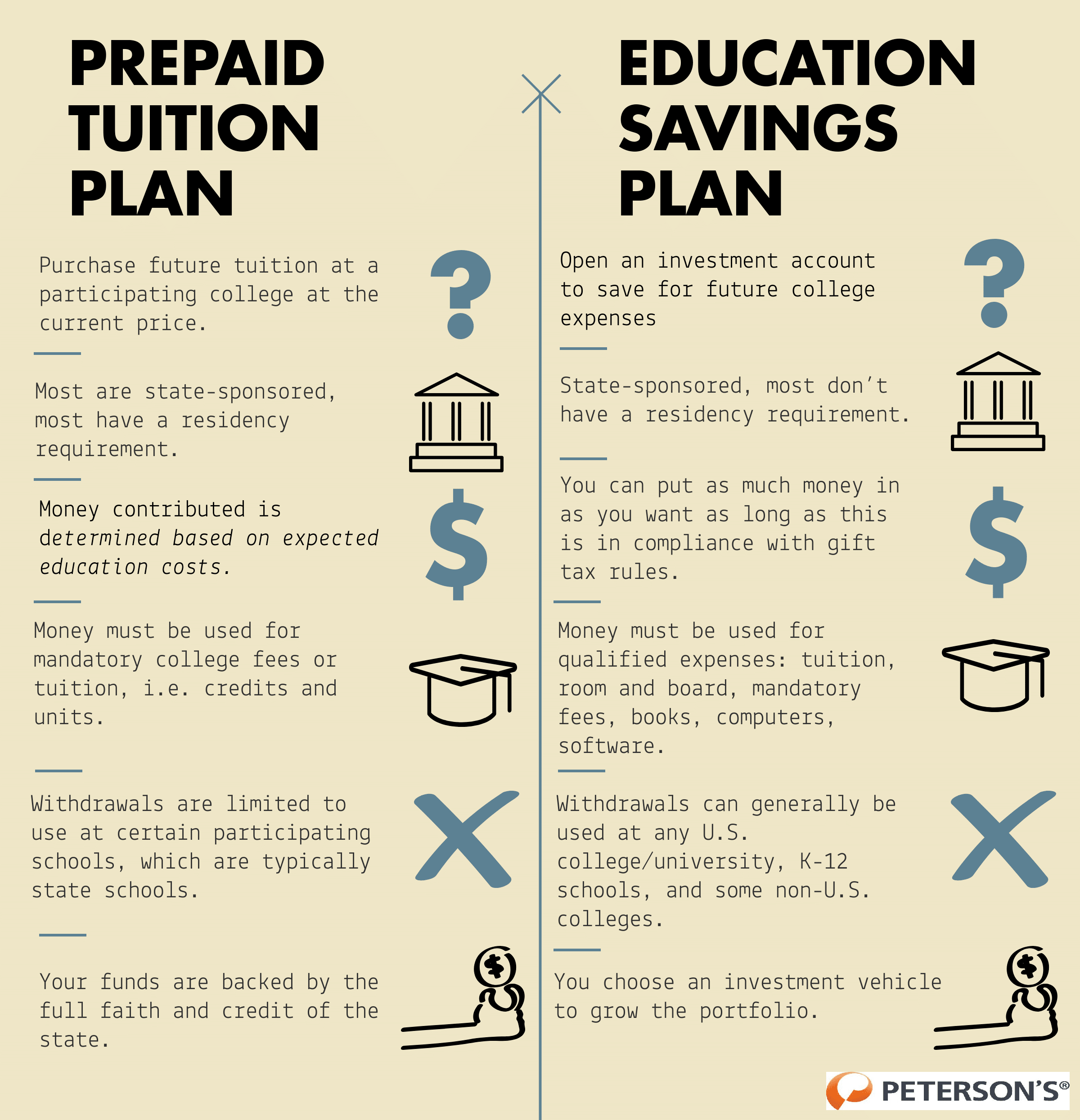

WASHINGTON The Internal Revenue Service and Department of the Treasury today announced their intent to issue regulations on three recent. This means that the 529 plan is the only college savings plan that. Contributing to a 529 college savings account can offer tax advantages including tax-deferred growth and tax-free withdrawals for qualified education expenses.

Keep More Money Now. Arkansas Taxpayers who contribute to an Arkansas plan can deduct up to 5000 or 10000 total for a married couple from their Arkansas adjusted gross income for. Ad Thinking About Saving For Your Childs College Fund.

Tax-favored Section 529 college savings plans also known as qualified tuition programs have been around long enough that many people are now withdrawing money to. IR-2018-156 July 30 2018. Have control over how you save for future college expenses.

NEBRASKA with the NEST Direct College Savings Plan taxpayers can deduct up to 10000 in contributions from their Nebraska taxable income each year 5000 if married filing. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer. The Path2College 529 Plan is.

However some states may consider 529 contributions tax deductible. Check with your 529 plan or your state. Ad Getting a Child to College Can Be Stressful.

Oregon 529 Plan Deduction 2020 will sometimes glitch and take you a long time to try different solutions. Although your contributions to a 529 College Savings Plan are not tax deductible. Report 529 plan contributions above 15000 on your tax return.

Choosing The Best 529 College Savings Plan For Your Family Smart Money Mamas

Louisiana S Student Tuition Assistance Revenue Trust

/GettyImages-956406468-87582e9ff55b4a8e88975ecc45a1afd3.jpg)

Clearing Up Tax Confusion For College Savings Accounts

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Why A 529 College Savings Plan T Rowe Price

Straightforward Guide To 529 College Saving Plans Root Financial Partners

Is There A Tax Deduction For 529 College Savings Plan

Plan Details Information Minnesota College Savings Plan

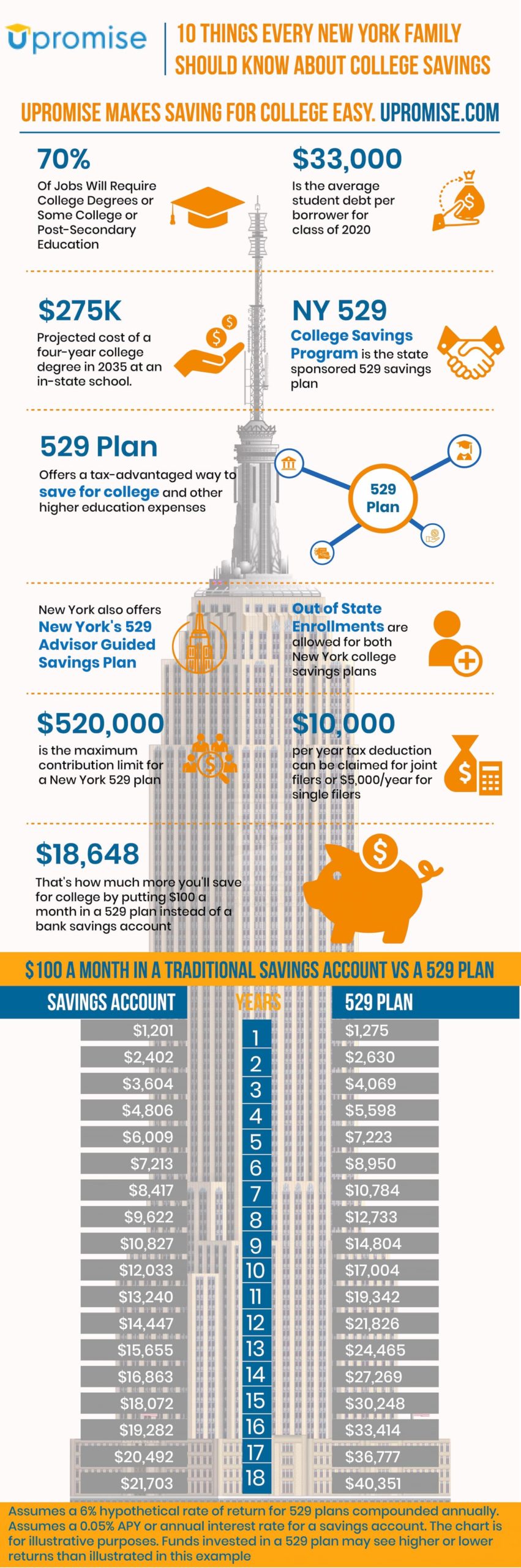

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

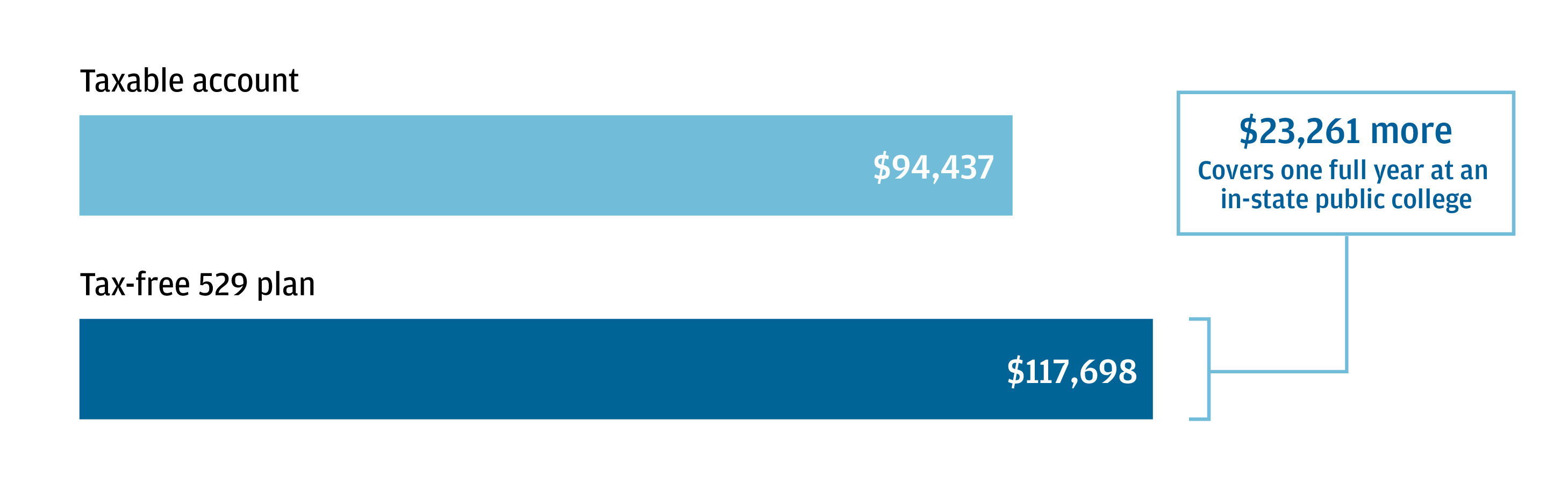

529 Plan Tax Benefits J P Morgan Asset Management

529 College Savings Plans Wealth And Investments Rockland Trust

Bright Start 529 Tax Benefits Bright Start

New Law Expands Uses For 529 College Savings Accounts The New York Times

Saving For College And On Your Taxes Understanding 529 Plans

Tips On Spending The Money In College Savings Accounts The New York Times

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps